Cranbrook City Council has approved the 2.88% tax increase, which includes a general increase of 1.88% and the 1% dedicated road tax.

According to the City of Cranbrook, the 1.88% increase represents inflationary pressures on operating costs and will add approximately $513,400 in revenue for City operations.

Previous: Cranbrook Council Proposes 2.88% Tax Increase in 2020 (April 29, 2020)

The 1% dedicated road tax represents about $273,400 in added revenue, allowing approximately $2.5 million for the 2020 Captial Works Program to complete various road improvements around the community.

Read: Annual Road Work Gets Underway in Cranbrook (May 5, 2020)

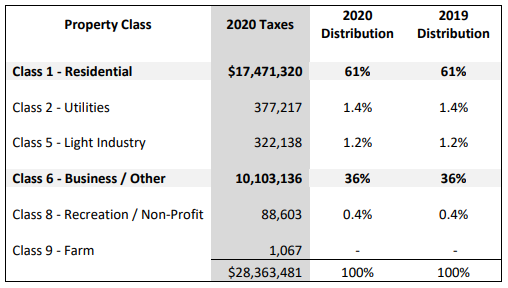

The general municipal tax burden in Cranbrook will be distributed between residential and commercial properties. Residential will carry about 61% of the burden, while commercial will pick up the remaining 36%. Utilities, light industry, and recreation or non-profit account for the remaining 3% of the tax burden.

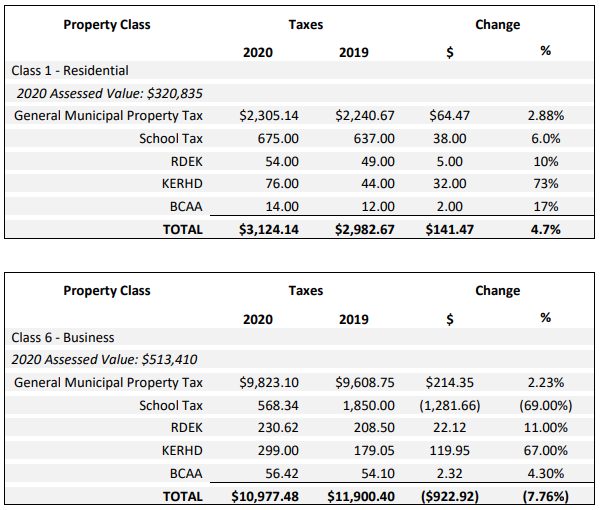

Given the 2.88% tax increase, the average increase for a residential property valued at $320,000 would be $64.47, while the business sector can anticipate an average increase of $214.35.

The City of Cranbrook calculated the additional increases to the School Tax, RDEK, KERHD, and BCAA to based on average assessed value. Residential properties should anticipate a $141.47 increase, while businesses can expect $922.92 in savings, given the large decrease to school taxes in 2020.

More: 2020 Tax Rates Bylaw (City of Cranbrook)