Residential tax rates will get a slight bump this year if the 2.35% tax increase is formally adopted.

Unanimously approving the proposed tax rate on Monday, City staff will now come with the formal tax rate bylaw on May 10th, which will then be up for three readings and adoption by Cranbrook City Council.

“I know that people are always not happy with tax increases but the bottom line is that this was a lot of time and effort and work put in by the staff and our finance department and the Council,” Mayor Lee Pratt told MyEastKootenayNow.com.

The 2.35% tax increase includes Cranbrook’s 1% dedicated road tax.

Cranbrook’s dedicated road tax has been implemented for the past number of years and serves as a major funder of the City’s Capital Works Program. The 1% tax in 2021 would amount to $2.78-million for road projects, including underground infrastructure.

With the 1% dedicated road tax deducted, the overall 2.35% tax increase represents a general increase of 1.35%.

“I think everybody knows that the City’s expenses have certainly increased more than 1.35% over the last year so I think it was a great job,” added Pratt.

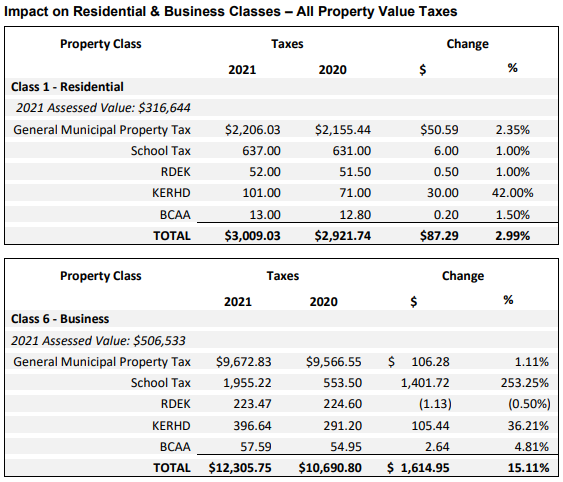

As per the City of Cranbrook’s estimated totals, a $300,000 home in 2020 would have a new assessed value of approximately $316,644 in 2021. With the new residential tax rate at 6.9% from 7.1% in 2020, the average homeowner can expect a $50.59 increase to their general municipal tax.

Businesses can anticipate a 1.11% tax increase with the 2021 business tax rate set at 19.1%, averaging out to an extra $106.28 for a business assessed at $506,533.

MORE: Proposed 2021 City of Cranbrook Tax Rates (City of Cranbrook)